Restaurant Chain Institutes New Policy Deducting Credit Card Fees From Servers' Tips & Threatens To Fire Them If They Complain

It's perfectly legal in most of the country, but virtually no one seems to think it's ethical.

Dejan Dundjerski / Shutterstock

Dejan Dundjerski / Shutterstock A pair of restaurateurs is under fire for a new policy they implemented in their Kansas City and Wichita-area franchises of the restaurant chain Twin Peaks.

The policy has sparked outrage among many people online, especially since some employees allege they have been threatened with retaliation if they so much as talk about it.

Restaurant owners Brad and Brent Steven have announced they will begin deducting credit card fees from servers' tips.

You've probably noticed it at many of the places you shop and eat. More and more, businesses are passing credit card processing fees onto customers and urging them to pay cash whenever possible in order to avoid them.

These fees, charged to businesses by the credit card companies themselves, typically range between 1.5 and 3.5% of each purchase, which really adds up, especially after many credit card companies raised the fees in 2022.

Passing those fees onto customers has caused enough consternation on its own. But passing them onto employees? That is, of course, on another level entirely.

Nevertheless, that's the solution restaurateurs Brent and Brad Steven have decided upon. Their company 3B Lodge runs the Kansas City- and Wichita-area locations of Twin Peaks, a chain of sports bars known for its skimpily dressed waitresses — think Hooters but with a mountain theme.

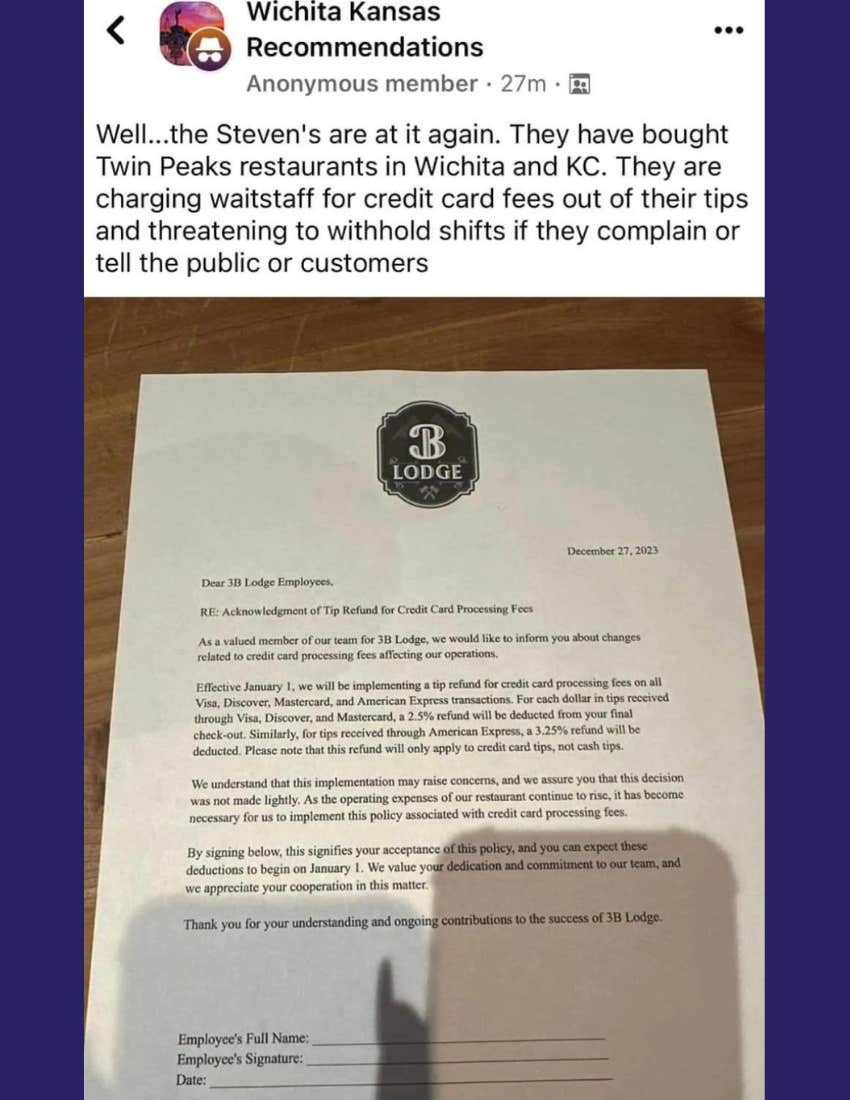

They sent a letter to the staff of their Twin Peaks locations letting them know that credit card processing fees will now be deducted from all servers' tips.

Employees say 3B has also threatened retaliation against any employees who object to them deducting credit card fees from servers' tips.

A screenshot of the letter that employees received from the Stevens' company first went viral on Facebook and has since sparked even more backlash on Twitter.

The letter states that credit card feeds will be deducted from tips beginning January 1, 2024, because "the operating expenses of our restaurant continue to rise."

It stipulates that there will be a 2.5% tip deduction "for each dollar in tips received" via Visa, Mastercard and Discover payments and 3.25% for American Express payments. The letter requires employees to sign at the bottom acknowledging their consent to the new policy.

"We understand that this implementation may raise concerns, and we assure you that this decision was not made lightly," the Stevens' letter reads. However, according to employees, that is not the spirit in which the change has been made.

Photo: @NutsNBolts1937 / X (Twitter)

Photo: @NutsNBolts1937 / X (Twitter)

Screenshots shared to Facebook include a caption accusing the Stevens of "threatening to withhold shifts if [employees] complain" about the new credit card fee policy or if they "tell the public or customers."

The new policy has sparked outrage online, but deducting credit card fees from servers' tips is legal in most states.

Assuming the allegations of intimidation are truthful, making such threats against employees for talking about a new policy is a pretty good indicator that the policy is problematic — and that the restaurants' owners know it.

But despite the outrage it has inspired, deducting credit card fees from servers' tips is entirely legal in most of the country. California, Maine, and Massachusetts prohibit the practice, while the law isn't clear in Delaware, Kentucky, and Montana.

But it is legal in the other 44 states as well as under the federal laws of the Fair Labor Standards Act, so long as the fee deductions are applied only to gratuity amounts and not the entire restaurant bill, as 3B's letter specifies.

Still, even if it's legal there's not really any justification for passing the costs of doing business onto employees, who are already paid so little. At that point, why stop at credit card fees? Why not deduct the cost of the food, too? It's an absurd overreach that essentially amounts to 3B charging its employees to work for them.

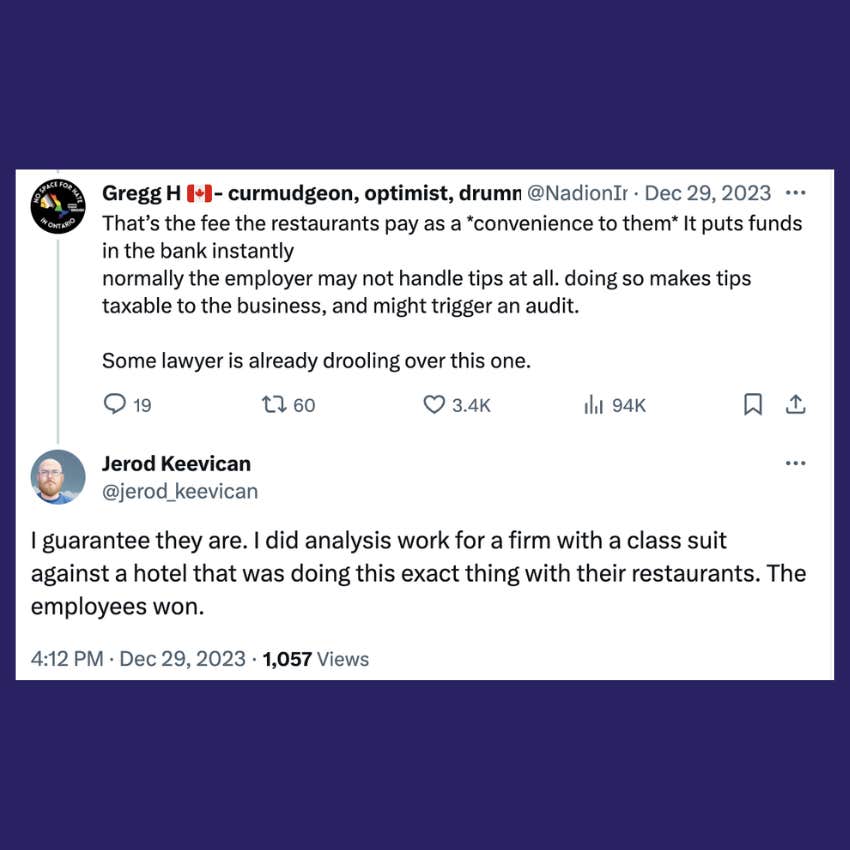

And while it may be legal, some online have claimed there is precedence for the practice to blow up in 3B's face — a lawyer on Twitter claimed to have done work on a class action lawsuit brought by hotel employees who were subjected to a similar policy. He says the employees won.

Photo: @jerod_keevican / X (Twitter)

Photo: @jerod_keevican / X (Twitter)

In the end, though, it shouldn't require any legal analysis to get to the heart of the matter here — cutting your employees' pay, directly or indirectly, to cover your rising business costs isn't appropriate.

And with the restaurant industry still struggling with post-pandemic staffing shortages, it's not a very smart business practice, either.

John Sundholm is a news and entertainment writer who covers pop culture, social justice and human interest topics.