27-Year-Old Driver Says His Car Insurance Increased By $200 A Month Because The Company Was ‘Concerned’ About The Time Of Day He’s On The Road

The company's AI software detected his driving habits, and as a result, his insurance increased.

antoniodiaz | Shutterstock

antoniodiaz | Shutterstock A 27-year-old man admitted that he was flabbergasted after his car insurance increased significantly, and when he inquired with the company about why, their answer didn't quite make much sense.

Posting to the subreddit r/GenZ, he claimed that he only had his car for less than six months when he learned he would be paying more for the insurance because of the times of day he was most frequently on the road.

The Gen Z driver's car insurance increased by $200 because the company was 'concerned' about the time of day he was on the road.

In his Reddit post, the young man explained that he was alerted that his car insurance would be increasing by $200. He pointed out that he's only had his car for 5 months and hasn't gotten into a single wreck or gotten any tickets. All he does is drive his car to work and right home after.

When he reached out to GEICO to inquire about the increase, they informed him that their AI detection software had picked up on his most frequent driving times and the "smoothness" of his driving, resulting in the increase.

Reddit

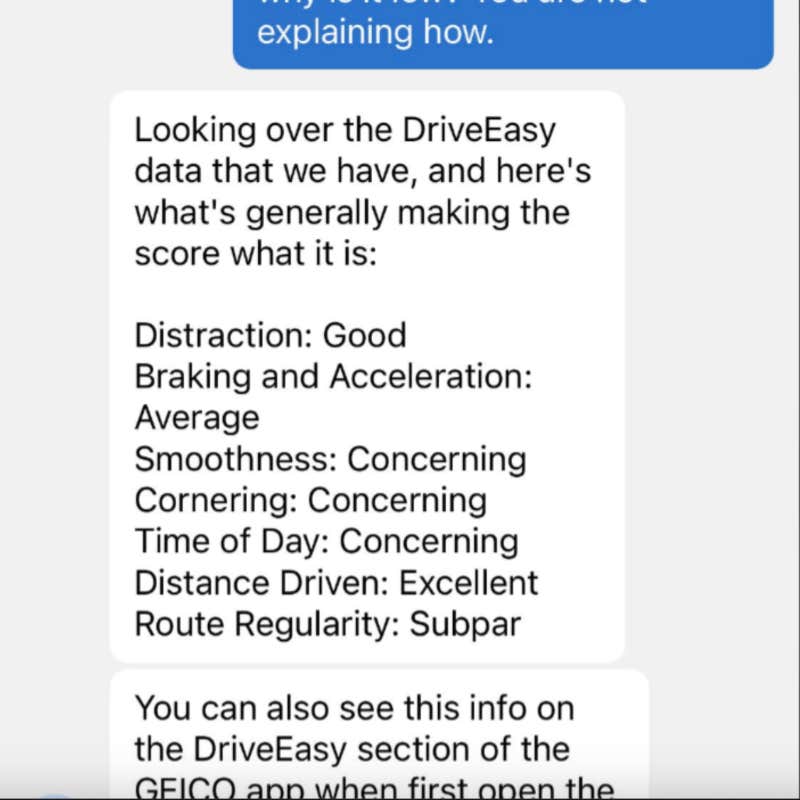

Reddit

"Looking over the DriveEasy data that we have and here's what's generally making the score what it is," a representative from the company messaged him. While his braking and acceleration were considered "average" and his distraction was found to be "good," his smoothness, cornering, and time of day were found to be "concerning," while his route regularity was "subpar."

According to GEICO, their DriveEasy safe-driving program allows drivers to control their rate by rewarding them with savings based on their driving behavior. GEICO then factors the score into a driver's insurance rate.

The program has received criticism from other customers who've enrolled in it.

In another post, this time to the subreddit r/Geico, a second driver criticized the company's usage of AI on drivers. He explained that the DriveEasy app is "badly designed," and the rankings are really determined by the kind of area that you're driving in.

"If you are based in an urban and/or hilly area, you will frequently be adjusting your speed (unless you want to just ram into the driver in front of you so you can maintain your good "smoothness" score). Conversely, being in a rural area such as the mid-west with long flat roads you will likely have great smoothness," he discovered.

"Because denser areas have more accidents, your territorial rates are already higher. Then the fact that you adjust your speed based on the conditions around you they actually penalize you for driving safely."

Many people argued in the comments section about the lack of privacy the program allows users. Since signing up with GEICO's DriveEasy app isn't required, people should just forgo it completely and stick with their regular plan.

A growing number of Americans may no longer be able to afford car insurance.

Rising insurance costs have been linked to a significant number of young Americans, roughly 45%, saying they've thought about going without auto insurance because of the expense, according to a new Deloitte report.

Car insurance costs have climbed 19% in 2023 compared to the year prior, marking the biggest yearly increase since 1976.

michaeljung | Canva Pro

michaeljung | Canva Pro

On top of that, vehicle repair costs are also up, meaning that if it costs more to fix an issue with your car, insurance companies will start charging more as well.

State Assembly Insurance Committee Chair David Weprin told Spectrum News that lawmakers are aware of the issues, especially for states like New York, where the findings regarding costs are disturbing.

"We're doing everything we can to try to keep these insurance companies in New York and to try to keep premiums reasonable," Weprin said, adding that the committee is having discussions with the superintendent of the state Department of Financial Services and the industry about potential options.

Nia Tipton is a Chicago-based entertainment, news, and lifestyle writer whose work delves into modern-day issues and experiences.