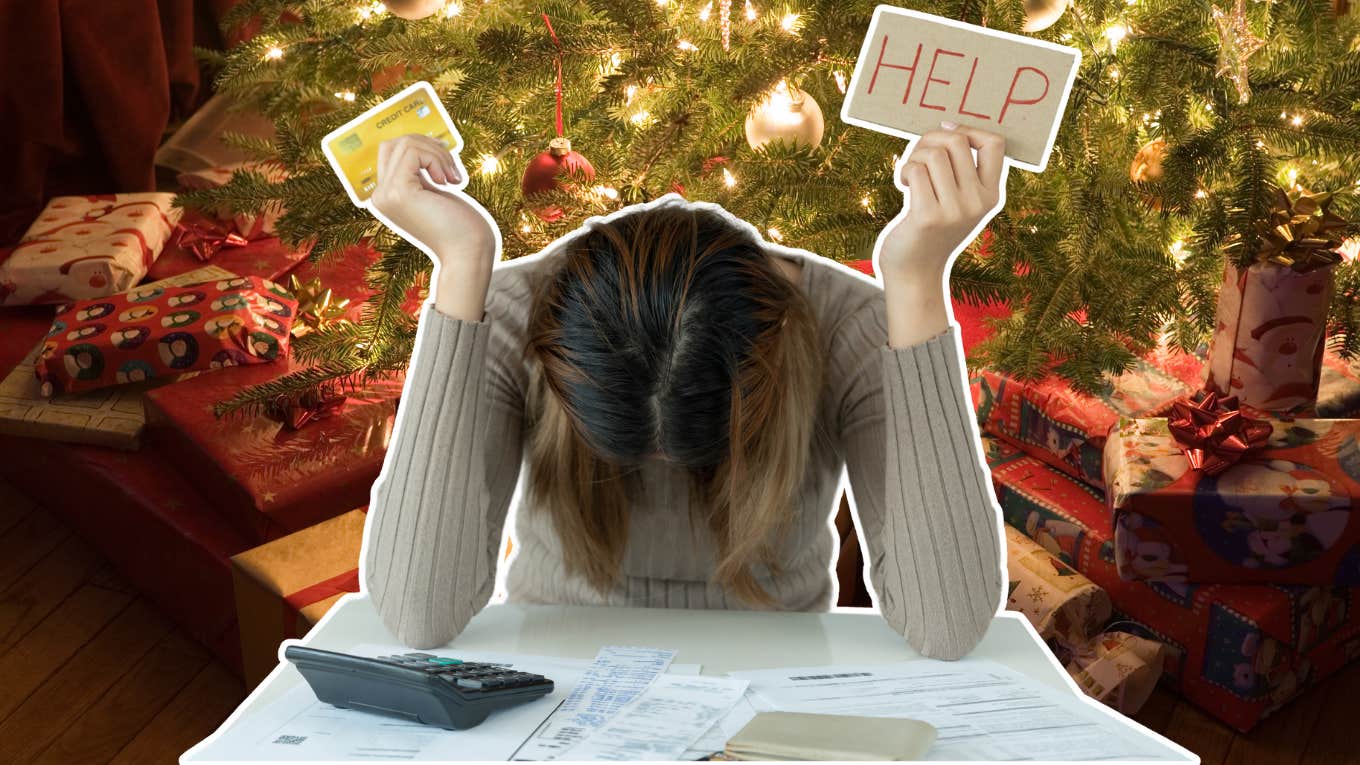

Millennials Used Credit Cards For 88% Of Their Black Friday Shopping This Year — & Most Can't Afford It

Overspending is always part of the season, but this year has some particularly jittery about their finances.

VisualField | Getty Images Signature | Nuttawan Jayawan | Getty Images | Canva Pro

VisualField | Getty Images Signature | Nuttawan Jayawan | Getty Images | Canva Pro 'Tis the season to go into debt — it's basically a holiday tradition at this point. But this Christmas just might be on a whole other level for millennials.

Despite economic concerns being the number one worry in the recent election, overall consumer spending this holiday season is stronger than in 2023.

However, a new study shows that millennials are really cringing as they hand their money over to "Santa Claus," and it's got them worried about the bills they'll face in January.

A study finds that millennials are going into more Christmas credit card debt this year than ever before.

The study was conducted by personal finance and money management app Piere, which analyzed 2,000 Millennial users over the last three years.

And when Piere's analysts recently crunched the numbers, they came to a fairly nerve-wracking conclusion: Christmas 2024 is poised to be the worst one yet for Millennial credit card debt.

Millennials used credit cards for 88% of their Black Friday spending, and credit card use has risen since 2023.

Piere's numbers are already pretty surprising, and we're only halfway through the shopping period. The app found that millennials used credit cards for a staggering 88% of their Black Friday purchases a few weeks ago, which seems to be setting a trend for the season as a whole.

That figure is up substantially from 2023, when it was at 79% — which, in turn, was up from just 70% in 2020. Cash, on the other hand, has been in steep decline among millennial Christmas shoppers for years, accounting for just 1% of purchases in 2023.

So, what are millennials buying with all this plastic? Holiday gifts, of course, but Piere found that millennials are also spending a lot on dining out, travel, entertainment, and charitable donations during the holidays.

However, while overall holiday spending has gone up among millennials for the last several years, it appears to be holding steady in 2024 compared to 2023. This is the opposite of national trends. Black Friday spending was up more than 3% overall since 2023, and the 2024 holiday season is expected to set a new all-time spending record, according to the National Retail Federation.

That suggests, of course, that millennials are feeling the economic pinch this year, perhaps more so than other demographics. And Piere found that there is plenty of anxiety about this issue among millennials because of it.

Nearly half of millennials are deeply worried they can't afford Christmas this year — and are even more worried about their January credit card bills.

Piere's data shows a stark divide between the "haves" and "have-nots" — or at least the "have lesses." Roughly half of the millennials Piere studied showed major anxiety about affordability and spending this holiday season.

Only 59% were confident they could even afford Christmas in the first place, and 52% said their financial anxieties soar during the holidays. Another 54% said they expect overall cost of living issues to impact their spending.

But even if it doesn't, millennials are deeply worried about January's credit card bills. Based on its study data, Piere predicts that millennials' normal spending will plummet by at least 70% in January compared to where it was this fall.

lisegagne | Canva Pro

lisegagne | Canva Pro

There are, of course, ways to keep holiday spending from spinning out of control. Many parents, especially millennial ones, advocate for the "4-gift rule" for the holidays, in which everyone gets "something you want, something you need, something to wear and something read" instead of the usual mounds of often meaningless junk that accumulates at Christmas.

Still, this situation is indicative of the wider economic landscape millennials, as well as Gen Z, currently face. As Piere's CEO Yuval Shuminer put it, these spending and debt patterns make it clear "that millennials will need more than just budgeting tools.

They need a shift in the financial landscape to ensure they can thrive, not just survive." Hear, hear.

John Sundholm is a writer, editor, and video personality with 20 years of experience in media and entertainment. He covers culture, mental health, and human interest topics.